Barcelona will see signs of reactivation in real estate investment throughout 2024, especially in the second half of the year. According to the report Real State Market Outlook 2024 by the consulting firm CBRE, which predicts a growth in investment of over 10% in the Catalan capital, to exceed 2,000 million euros and after a 2023 in which the sector has recorded a fall of 49% in the Barcelona area.

Specifically, the investment volume of the Barcelona real estate market has closed 2023 with 1,821 million euros, almost half of the 3,586 million in 2022 3,654 million 3,654 million in 2021The two years were record-breaking as the pandemic was put behind us. The evolution is in line with the 48% drop in real estate investment at the European level. In Barcelona, the hotel segment led investment, with 578 million euros, followed by the industrial and logistics sector, with 555 million euros.

The 578 million in real estate investment in hotels represented the third best year in the historical series, in a 2023 marked by several major operations, such as the purchase of the Mandarin Oriental 240 million from the Saudi Arabian group The Olayan, and the acquisition of Hotel Sofiawhich Blasson Property Investments and Axa bought for 180 million. The pace at which 2024 has started in this area has not been slower: Miramar and La Florida luxury hotels have been acquired by the socimi Atom Hotels for 50 million euros. All in a context in which the opening of hotels is restricted in the city through the Urban Plan for Tourist Accommodation (Peuat), which the head of CBRE Barcelona, Xavier Güell, has called for flexibility. “We can think in a very controlled, punctual and studied way to allow the entry of high value-added chains. We know that there is a lot of desire,” he assured.

Residential real estate investment declined by 68%, although flexible housing units soared by 147% to 45 million

With 555 million euros, the industrial and logistics sector followed closely behind hotels in terms of real estate investment. This is a “record investment volume”, although lower than that of 2022, when 16% more was recorded. This figure represents 44% of real estate investment in this sector in Spain as a whole. However, contracting fell by 43.2% in 2023, to 536,000 sqm. This figure is due, in part, to low availability, which will experience a slight upturn in 2024, according to the consultancy, which forecasts that in 2024, contracting will increase to 600,000 square meters leased, according to Güell.

The housing sector recorded 323 million of investment in Barcelona. The figure represents a 68% decrease compared to 2022, which was marked in particular by the 600 million purchase of 1,500 Patrizia homes from BCorp. “If this transaction is not taken into account, the decline is more moderate,” Güell pointed out.

The investment in housing in Barcelona and its surroundings takes into account the traditional residence but goes beyond, as it includes alternative models such as the colivingstudent residences, senior living and serviced apartments. These flexible housing arrangements soared 147% in 2023 and reached €45.4 million, as detailed by the head of Research at CBRE Barcelona, Marta Tarrío.

Office conversion

In view of the high demand and lack of supply in the residential sector, Güell has called for public administrations to facilitate the work of private developers so that between 12,000 and 15,000 new homes enter the market each year.The head of CBRE Barcelona said that the number of new buildings will double the current figures.

Güell considers that one way to put more housing on the market is the conversion of offices, in a context in which real estate investment in this area recorded a 76% drop in Barcelona in 2023, when it reached 261 million euros. Office take-up fell by 23.7%, in line with other European cities. “As the international market recovers, Barcelona will also likely experience an above-average recovery.” Güell predicted. In this line, he predicted that 2024 will exceed 250,000 square meters of office space, compared to 231,000 square meters in 2023.

Looking ahead to the year that has just begun, Güell predicts that office vacancy levels will increase, also as new developments are expected to come onto the market, such as the Estel Building. They also expect vacancy to increase in certain areas of 22@, while it has been maintained in the city center.

Under these circumstances, the CBRE executive has opted for obsolete offices to accommodate other uses, such as residential and hotels. “Cities must be alive and adapt to the new times”, so he has asked to make regulations more flexible to admit these changes and bring back to life office buildings that have become obsolete: “There is nothing worse for a city than an abandoned building”.

A future of health and AI

In this situation, the head of CBRE Barcelona has defended the rethinking of offices, especially in 22@, mainly intended for this use. The city made a bet on articulating this technological district two decades ago and did it in the right way, according to him. Now, more than 20 years later, he believes that the city must again choose in which areas it wants to position itself: “We have to choose where we want to be for the next 10 to 15 years. Technology will continue to lead the way, but no longer in such generic terms, but now we have to be more specific.”

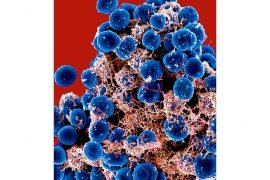

CBRE believes Barcelona should concentrate its focus on health sciences and AI in the coming decades

The powerful technological fabric that Barcelona has developed over the past decades gives it the flexibility to focus on specific technologies, which CBRE argues should be AI and health-related sciences. “It is difficult to find another European city that has the structure that Barcelona has to be able to be one of the big ones. hubs from life science of Europe.

In fact, 950,000 square meters are expected to be developed in this sector over the next few years in Barcelona, which includes 45,000 square meters of the future Ciutadella del Coneixement19,000 of the CaixaResearch Institute and the consolidation of the Parc Científic de Barcelona, with 330,000 square meters, in addition to more than 550,000 square meters of the future BioCluster of Innovation and Health in L’Hospitalet de Llobregat.

The life science life science in Barcelona and its surrounding area is made up of some 420 startups, 20 university hospitals, 12 universities, 91 research institutions and 247,000 jobs. It also has public-private collaboration projects that should be “promoted and exploited”, according to Güell, who has highlighted the relevance of this sector and also the importance that AI will have in the future: “We believe that this is where Barcelona should pivot in the coming years”.

It is a future that Barcelona faces after a 2023 that has represented “the closing of an expansive stage at the real estate level”, according to the responsible Güell. The end of this cycle, which began in 2014, opens a scenario with new rules of the game. “Faced with this decline, some believe that the game is over; I believe that the game has just begun,” Güell emphasized, and strategists in the sector wait for moments like this to configure their investment portfolios.