[dropcap letter=”B”]

Blockchain is the technology defined in 2009 to create bitcoin, the virtual currency, by Satoshi Nakamoto—the nickname of a mysterious legendary figure in the virtual currency community. In 2008, Nakamoto published the paper Bitcoin: A Peer-to-Peer Electronic Cash System where he described “a purely peer-to-peer version of electronic cash.” In 2009 he deployed the Bitcoin software, with which he created an eponymous network, and on January 3, 2009 the initial launch of the first units of the bitcoin digital currency—with symbol ₿ and currency code BTC—was made. Bitcoin is the implementation of a concept conceived in 1998 by cryptographer Wei Dai, who published a post on the Cypherpunk mailing-list outlining a system for the exchange of value and execution of contracts based on an untraceable electronic currency. He called the currency b-money. In October 2015, Satoshi Nakamoto received The Economist Innovation Award in the special No Boundaries category for his invention, “which could radically alter the international financial system […] would eliminate the need for trusted third parties like the central banks in the transmission. Of cash, it could reduce the cost of credit cards and other fees in transactions, and attract those who defend privacy.” Nakamoto shared the limelight with other award-winners, including some of the leading technology companies of the times: Tesla Motors, Alibaba Group, Spotify, Uber, Dropbox and Box. UCLA professor Bhagwan Chowdhry decided to nominate the creator of bitcoin Satoshi Nakamoto for the 2016 Nobel Prize in Economics. The proposed nomination of Satoshi Nakamoto for the 2016 Economics’ Nobel was rejected by the Royal Swedish Academy of Sciences because it could not be awarded if the winner was “anonymous or has died” the press office said.

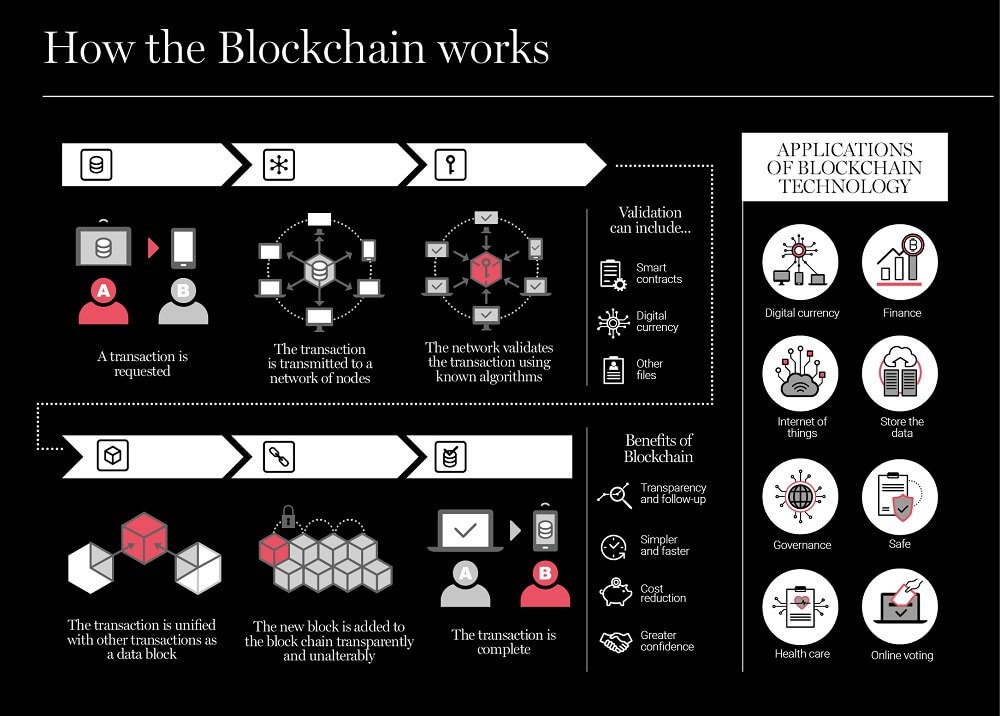

FUNCTIONALITY OF THE BLOCKCHAIN

The basis of the success garnered by Bitcoin, and more recently by Ethereum and many other virtual currencies, lies in the technology that supports it. Multiple applications are thus emerging for blockchain that go beyond virtual currencies. This trend grew further still after the incorporation into blockchain technology of a new functionality known as smart contracts, which lets you not only record a transaction in the ledger, but also contracts or sets of transactions liable to be executed in the future if they fulfil a series of conditions as stipulated in the contract. The scope of new applications is so broad that it can reach a wide range of sectors. That is why we talk of the blockchain phenomenon as the “industrial internet revolution.” “Blockchain will do for transactions what the internet did for information,” says the MIT Technology Review, attributing “the second digital revolution” to this technology and the potential to change the future of trade. The Harvard Business Review describes it as a “quiet revolution.”

In the same way the internet changed the business models of centuries-old industries and businesses forever, since its appearance in 2009 blockchain has been shaping a new economic pattern based on the decentralisation of confidence, in which we can all exchange goods and services without the need for third party intermediaries. This implies an unprecedented move forward that will revolutionise the way we organise our digital lives. In fact, some say we have gone from the Information Internet to the Internet of Value. Blockchain is a revolutionary breakthrough capable of transforming the way everyone interacts and carries out any kind of operation. Businesses in the financial, legal, energy, health, industrial, trade or intellectual property sectors may be seriously altered. Blockchain is considered by many experts to be the next major technological disruption in the second decade of the 21st century.

A NEW INTERNET AGE

The Internet is entering a second age, that of the Internet of Value. The first was a convergence between computing and communication technologies. This second one feeds of a combination of cryptography, mathematics, software engineering and behavioural economics. Blockchain is the flagship disruptive technology of the second age of the Internet, and the basis of the fourth industrial revolution. So far we have always needed a third party in which two sides trust to guarantee the authenticity of transactions, whether it is a bank, an auditor, a notary or PayPal, for example, with a record or a stamp of veracity. Blockchain solves this problem by combining peer-to-peer (P2P) technology, exchanges between equals applying cryptography, and thus creating a new form of digital communication and interchange. Blockchain means the end of data centralisation. It is a technology that allows the transfer of digital data using highly sophisticated codes in a completely irrefutable, secure way, on a distributed platform displacing traditional intermediaries and putting an end to centralised control. It is like a company’s ledger where all debit and credit entries are recorded; in this case, we’re talking about a distributed events ledger.

Blockchain technology is based on four fundamentals: the transactions record (ledger), the consensus to verify transactions, a contract that determines the rules of operation of the transactions and, finally, the cryptography, which is the corner-stone for it all. But not all blockchains are created in the same way. Some are public—often described as non-permissioned or permissionless—where anyone can access and store data in a block chain anonymously. Other blockchains facilitate online transactions between authorised blockchains, also called private blockchains, where participants are known and need permission to access, read or add information to the blockchain.

VIRTUAL CURRENCIES & ICOs

Virtual assets is the term used for the array of virtual currencies and other forms of goods and services that use cryptography —and by extension, blockchain technology— to function. The most popular are virtual currencies, but there are others such as smart contracts, tokens or systems of governance that come into this category. There are over 1,500 virtual currencies, with very volatile capitalisation that currently stands at half a trillion dollars. Just Bitcoin, Ethereum and Ripple together accrue over 50% of market capital. The 19 largest fortunes in virtual currencies accrue $26.4 billion, according to Forbes’ Crypto Rich List. There is an echo of Friedrich von Hayek in every virtual currency. His criticism of the State monopoly in banknote issuance is materialised in the virtual currencies, which restore to private users the power to issue their own currency. How? By mining. The thought of the Austrian School of Economics resonates in the lines of code of every virtual currency. There is also a much earlier idea than Hayek’s, a common nexus in all the undercurrents of liberalism. This nexus, rather than an idea, has become a value of that political philosophy: the free market, which underlies the foundation of virtual currencies.

What are ICOs? An ICO or Initial Coin Offering is a financing mechanism for a project or company made over the Internet through the massive sale of a virtual asset. In an ICO, a project in search of money issues a certain amount of virtual assets or tokens on a previously existing Blockchain platform and delivers them to investors in exchange for virtual currency. The entire operation is developed using smart contracts that are responsible for automating the process of distribution of tokens according to the requirements established by the ICO promoter. When the condition for payment is met, the contract assigns and sends the number of corresponding tokens to the investor’s portfolio automatically. One single platform contains 1,843 ICOs in 162 countries distributed throughout more than 20 different industries.

WHAT REGULATION WILL THERE BE?

Spain has joined the global drive to propel regulation of the new virtual currency economy. It has opted for a legal framework that protects investors and entrepreneurs who choose the token economy as a means of financing. Spain’s CNMV —or National Securities Market Commission— and the Bank of Spain have issued a statement in which they underline the need to undertake changes in the regulatory system of financial markets as soon as possible. On February 8, 2018 they published a joint release on “virtual currency” and “virtual initial currency offers” (ICOs). Many national and international authorities have already issued warnings regarding the risks they represent for investors. One of the most relevant in the European sphere is one published by the European Securities and Markets Authority (ESMA) in November 2017. On a global level, on January 18 the International Organization of Securities Commissions—IOSCO issued a communiqué which additionally provided access to those already made by several national supervisory bodies. On February 7, the finance ministers and the governors of the central banks of France and Germany sent a joint letter to the Minister of Economy of Argentina, who currently holds the presidency of the G20, in which they requested the inclusion of phenomena such as Blockchain, virtual currencies and ICOs, and the issuing of a report by the International Monetary Fund to analyse the implications of virtual currencies for financial stability, and a move towards cross-border regulation.

BLOCKCHAIN & GOVERNANCE

The new social order of the 21st century implies the loss of confidence in traditional institutions. However, these will not disappear, but it will give rise to a redistribution in the relations of power. By returning control to the people, blockchain removes the traditional intermediaries —central banks, patents and records offices, notaries and depositors of contracts, electoral commissions, energy companies, and so on— and opens the door to new forms of personal expression, social ecosystems and economic interactions. Blockchain technology, understood as a chain of blocks that provides a steadfast record of transactions made through a network, will have significant social and economic implications. Blockchain has the potential to transform entire industries and to be a force for transparency and integrity throughout the world, eradicating bribery and corruption and transforming social, economic and political paradigms.

In blockchain technology we have the potential to store, verify and transmit anything of value for the human condition: birth certificates, driver’s licenses, intellectual property rights, professional recognition, educational titles, bank accounts, medical records, insurance policies, donations, legal contracts, and also ballots. We can now imagine this potential in the world of digital government, authenticating any document, any transaction safely and directly. A new, disruptive way of carrying out faster, more secure and totally digital forms of government and administration. With huge potential. The future is here, a more open, safe, transparent, inclusive, reliable future with a strong digital component.